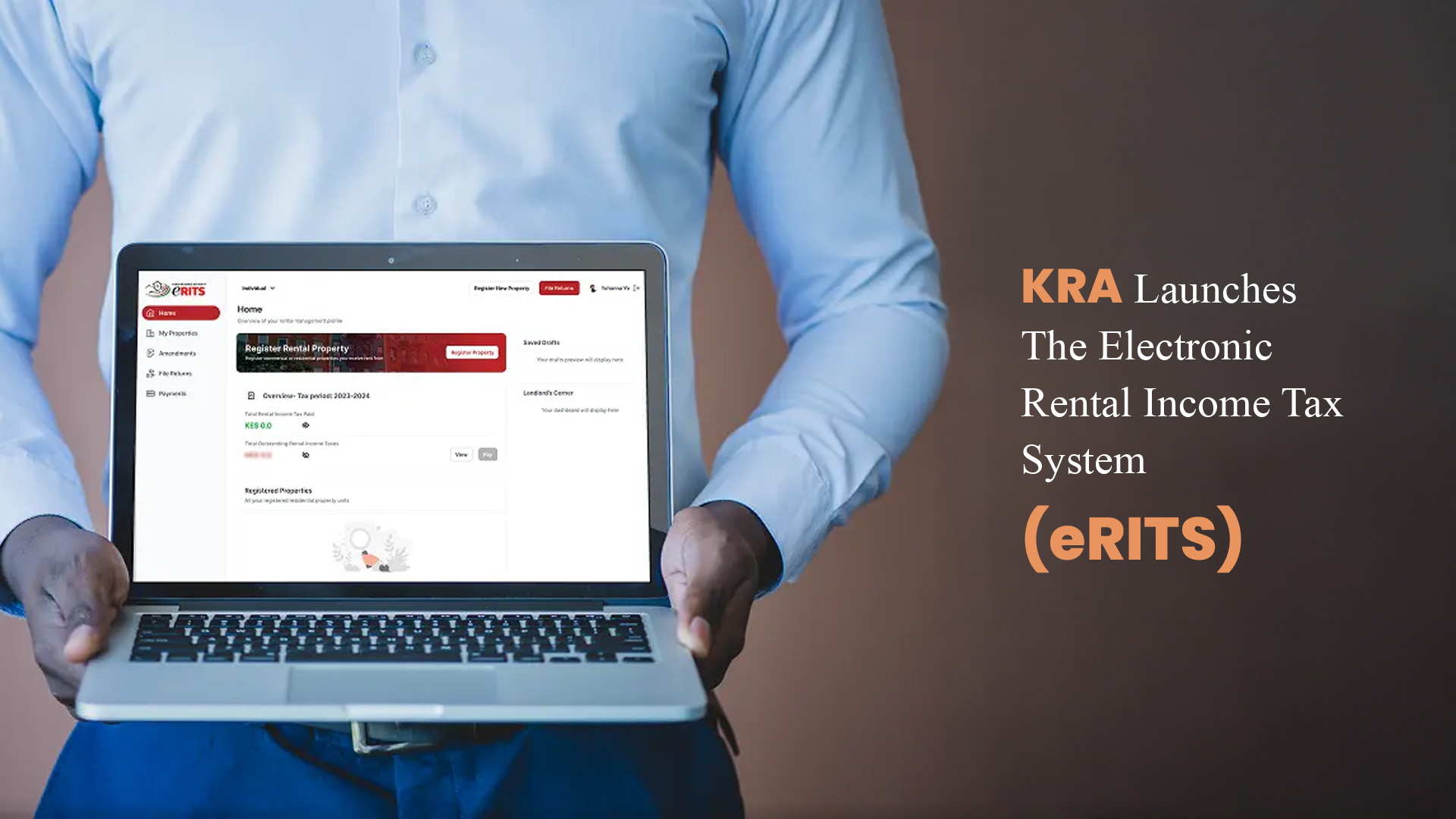

Kenya’s Real Estate sector continues to evolve, and with it, the systems that govern how investors manage and declare their income. In a move aimed at simplifying compliance and increasing transparency, the Kenya Revenue Authority (KRA) has launched the Electronic Rental Income Tax System (eRITS), a digital platform that allows landlords and property investors to declare and pay their monthly rental income tax online.

Introduced in September 2025, the eRITS platform is part of KRA’s broader plan to digitize tax administration and make the process more efficient for property owners. Through erits.kra.go.ke or the eCitizen portal, landlords can now easily register their properties, update their details and make payments directly through the system. This marks the end of manual submissions and the beginning of a streamlined, transparent, and easily accessible process for all investors earning rental income.

For property investors who have purchased apartments to generate rental returns, this change is particularly significant. The new system not only saves time but also provides a clearer record of each property’s tax compliance status. By linking properties directly to an owner’s tax PIN, eRITS enhances accountability and ensures that investors maintain accurate and up-to-date financial records.

KRA has emphasized that all rental property owners must onboard their units onto the eRITS platform and file monthly returns accordingly. Those who fail to comply may face penalties or interest on unpaid taxes. However, the process has been designed to be simple and user-friendly, making compliance easier than ever before.

Beyond convenience, this shift marks more than just a change in tax procedures, It reflects the steady transformation of Kenya’s real estate market into a more transparent, efficient and investor-driven space. As the sector embraces digital systems like eRITS, investors who stay informed and compliant will be best positioned to protect their returns, build lasting value and thrive in a future where accountability and innovation define Real Estate success.